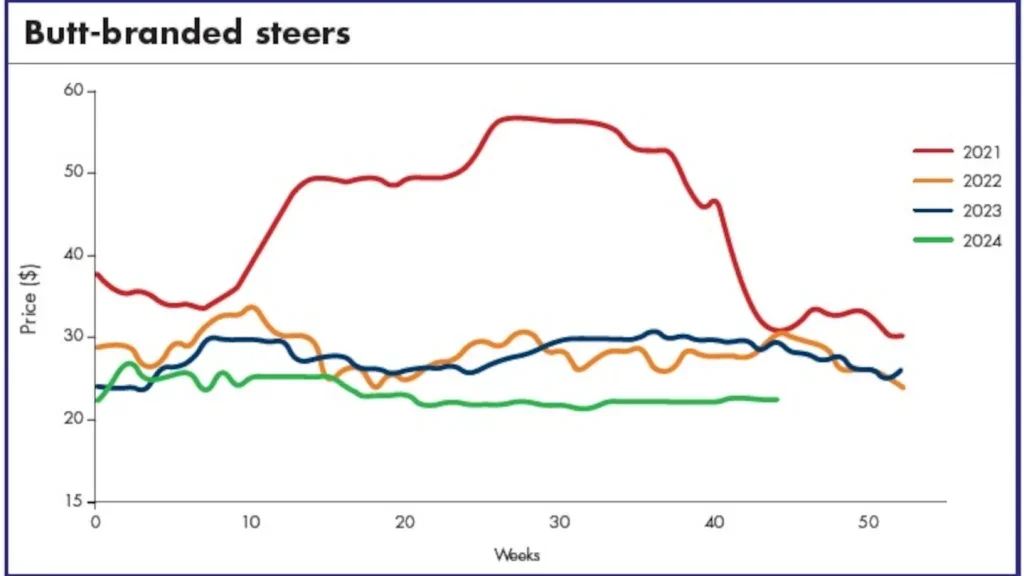

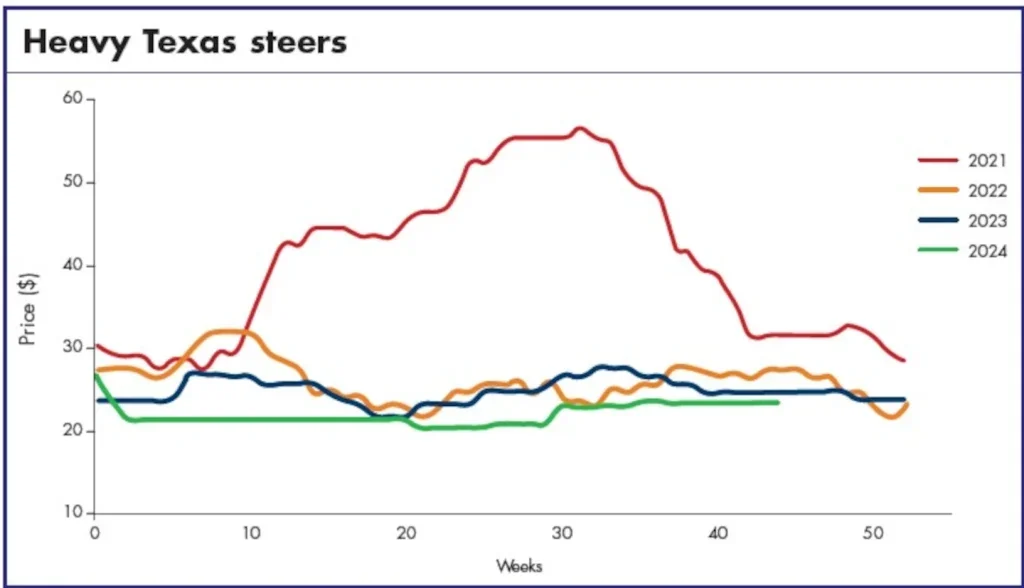

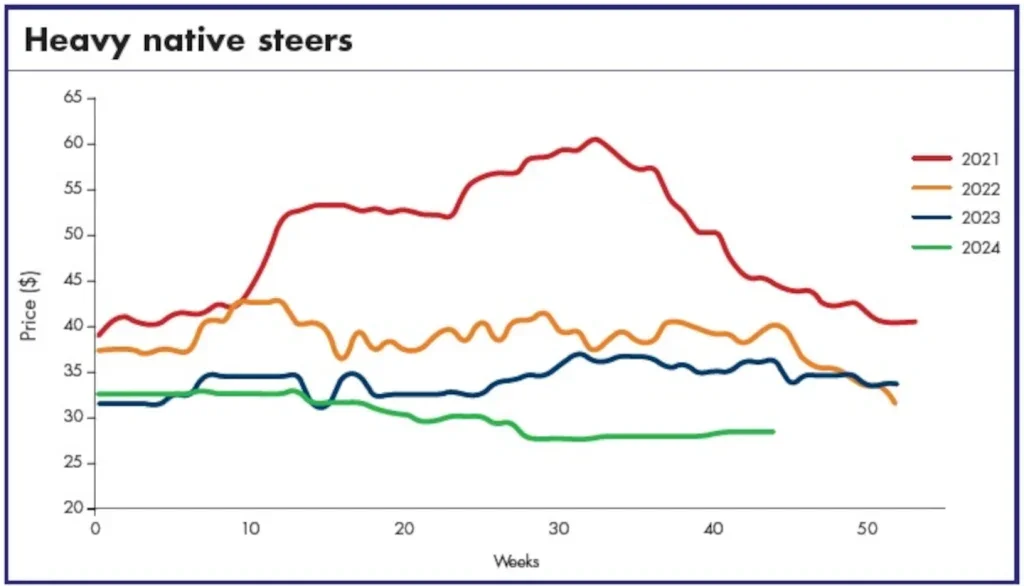

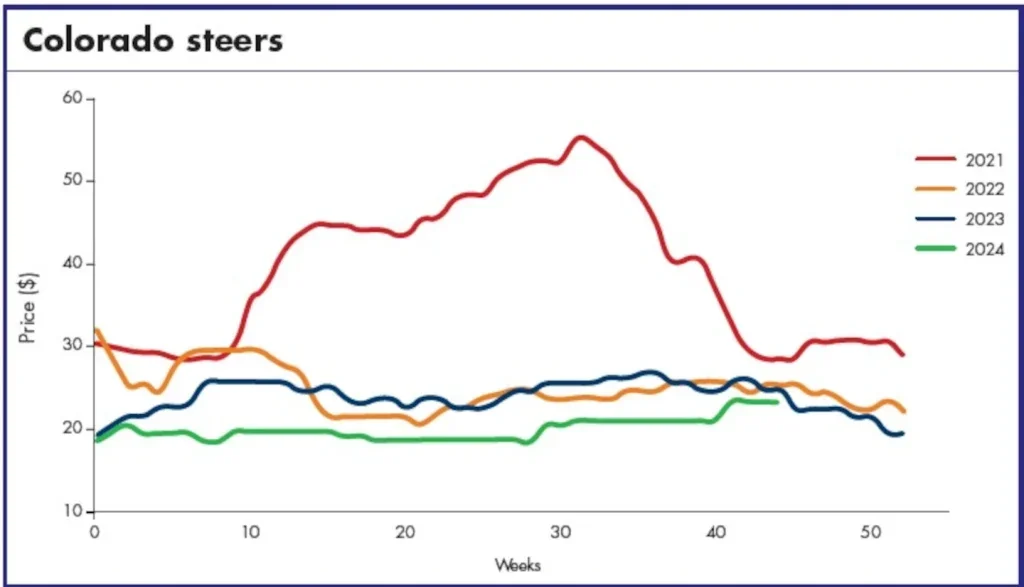

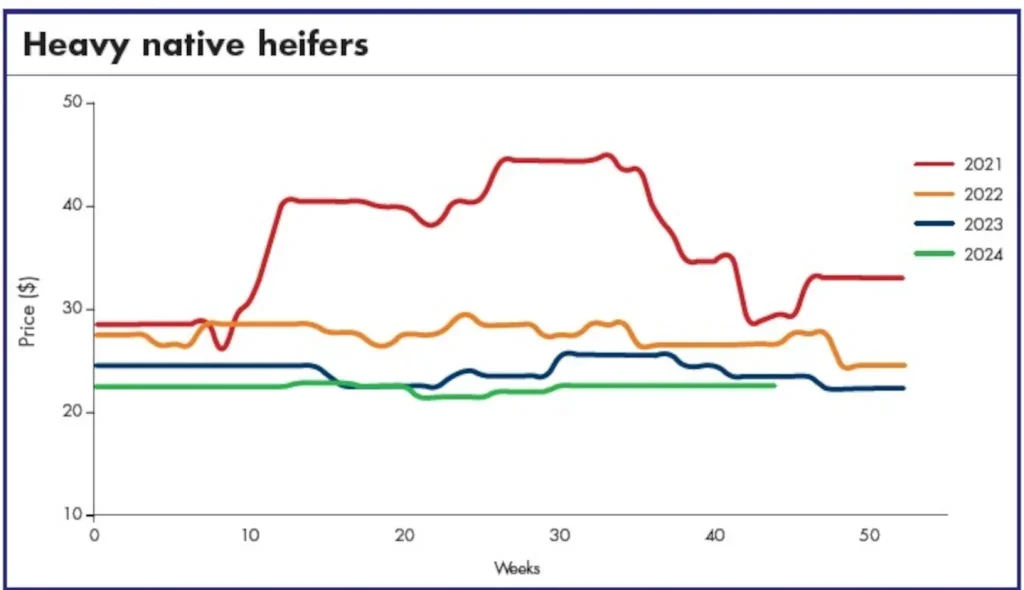

The market for Heavy Texas Steers, Butt Branded Steers, and Heifers demonstrated resilience, with prices remaining firm despite fluctuations in buyer activity. Heavy Texas Steers consistently sold at around $23 to $24 per piece, while Butt Branded Steers, which held a strong position, maintained prices at $25 to $26 per piece. Heifers showed a slight softening in early August, dipping to $17.50, but firmed later in September to around $18 per piece as demand stabilised. Branded Steers, however, dropped from $21.50 to $21 toward the end of September.

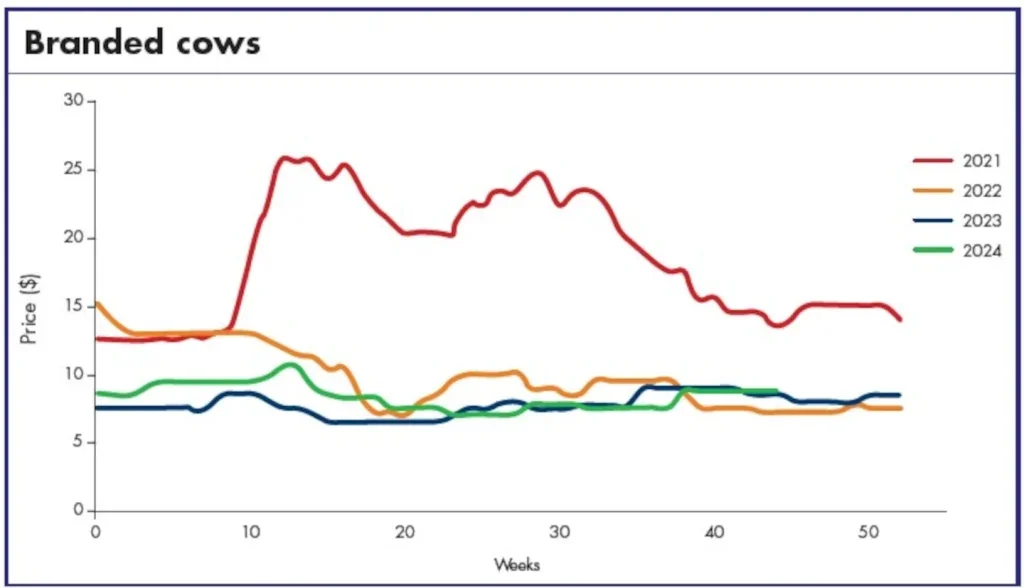

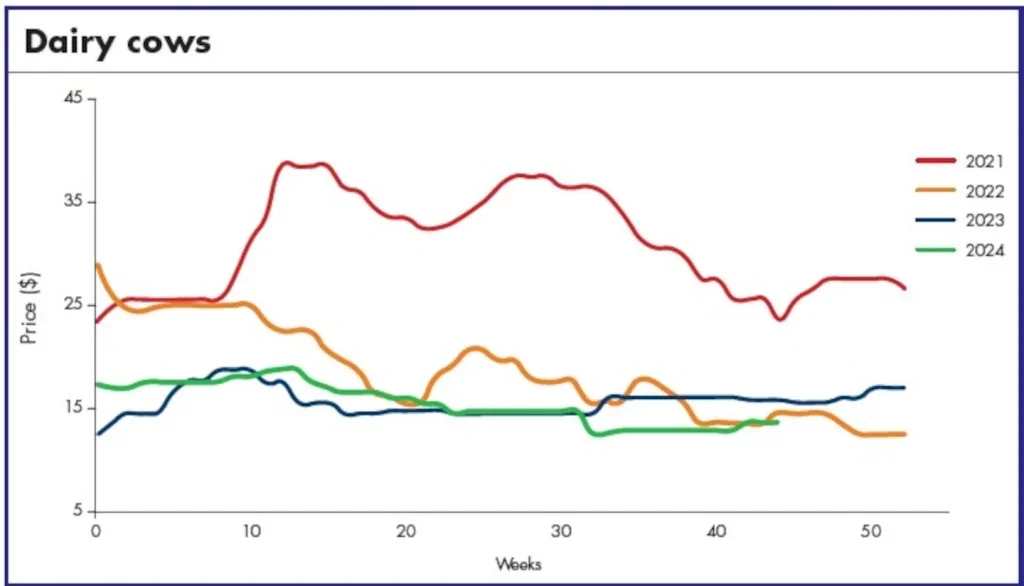

Despite stable prices in some categories, the overall market was characterised by ongoing challenges, including shifts in demand from international markets, particularly China, and logistical delays. In early August, there were reports of softening in Branded Heifers and Cows, with Branded Cows seeing price drops of $2 per piece. This reflected some of the broader economic pressures the market faced, particularly with lower than expected bids and subdued activity from international buyers. As a result, the market sentiment during this period was one of cautious optimism, as sellers resisted lower bids and held out for more favourable offers in key categories.

By late September, the market remained stable. Sellers continued to hold firm on pricing, particularly for Heavy Steers and Branded Steers, despite some softening in other segments. The hide market appeared to be balancing between supply pressures and fluctuating demand, with no clear sign of a major market shift in either direction.

Exports

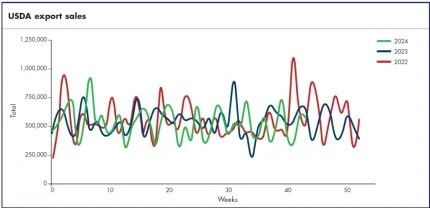

US export numbers during August and September revealed notable fluctuations, with early declines followed by some recovery in both raw hides and wet blue sales. In early August, raw hide sales saw a drop of 38%, with net sales reaching only 275,100 pieces. This decline was attributed to reduced demand from major buyers, including China, Korea and Thailand. By mid-September, however, raw hide sales began to pick up, increasing by 21% to 437,900 pieces as demand rebounded, particularly from China, which accounted for the bulk of purchases.

In addition to the market movements, external factors also contributed to the volatility. Extreme weather, such as heat warnings across several states, added disruptions to logistical operations. Additionally, global unrest, with geopolitical tensions escalating in various regions, further compounded market uncertainties. The gap between sales and shipments pointed to potential future pricing shifts, as backlogs continued to affect market performance. Sellers and buyers alike navigated these complexities with caution.

Wet blue sales followed a similar pattern of decline and recovery. In early August, sales dropped by 7% from the previous week, with net sales of 144,700 pieces. However, by September, wet blue sales surged by 128%, driven by demand from Vietnam, China, and other key markets. Despite this, overall wet blue sales remained lower compared to earlier in the year, and shipments lagged behind, indicating ongoing logistical challenges. Shipments in September averaged 114,675 pieces, down from the August average of 146,975, reflecting difficulties in moving products through the supply chain.

In terms of exports, China continued to dominate as the largest buyer of US hides and wet blues. However, there was also notable demand from Vietnam, Thailand and Mexico. Despite these positive developments, the overall market faced challenges from fluctuating buyer interest and continued resistance to price increases, particularly in the wet blue segment. Sellers continued to adopt firm pricing strategies, which maintained some stability, but the gap between combined sales and shipments suggested that unresolved logistical issues could affect future market pricing.

By the end of September, raw hide sales had risen by 39%, with net sales of 416,800 pieces for the week ending 19 September. Wet blue sales also saw a 12% rise during this period, but the overall trend pointed to a market attempting to stabilise amid external pressures and logistical delays. Shipments of raw hides and wet blues remained behind sales figures, suggesting that the market still faced hurdles in meeting international demand in a timely manner. Sellers maintained firm pricing strategies despite the pressure from buyers, indicating cautious optimism for future recovery as the market navigated these ongoing challenges.

US cattle on feed up by 1% in August

As of 1 August 2024, US feedlots with a capacity of 1,000 or more head had 11.1 million cattle on feed, reflecting a 1% increase from the same time last year. In July, 1.7 million cattle were placed in feedlots, a 6% rise from 2023, with net placements totalling 1.65 million. Placements by weight category included 390,000 head under 600lbs, 265,000 head between 600-699lbs, 385,000 head between 700-799lbs, 387,000 head between 800-899lbs, 200,000 head between 900-999lbs, and 75,000 head over 1,000lbs.

Marketings of fed cattle for July reached 1.86 million head, an 8% increase from the previous year, reflecting strong market activity as demand for beef remained high. Other disappearance, which includes deaths and other removals, totalled 56,000 head, a 14% decline from July 2023, suggesting improved feedlot efficiency.

Overall, the report highlights steady growth in placements and marketings, with feedlot inventories maintaining slightly higher levels compared to last year.

Hide market

The hide market continued to grapple with oversupply issues, as slaughter rates consistently exceeded sales throughout August and September 2024. Federally inspected slaughter numbers remained high, averaging around 600,000 head per week, with the week ending 3 August seeing 593,000 head processed. However, combined export sales and domestic consumption fell short of this figure, totalling 444,800 pieces, leaving a surplus of 148,200 hides. This pattern of slaughter exceeding sales persisted, with the week ending 28 September recording 612,000 head slaughtered, while combined sales reached only 503,200 pieces, resulting in a surplus of 108,800 hides.

The steady supply of hides put pressure on the market, particularly as international demand fluctuated. In early August, the market faced challenges from declining sales of raw hides and wet blues, with low bids from international buyers leading to fewer transactions. Despite these headwinds, the market showed some resilience, particularly in categories like Heavy Texas Steers and Butt Branded Steers, which held firm prices throughout the period. However, Branded Steers and Heifers faced some softening, with prices for Branded Steers dropping to $21 per piece by late September.

The wet blue market also faced challenges, with sales and shipments lagging behind earlier levels. In September, net sales of wet blues averaged 75,400 pieces per week, down from the August average of 124,375. Despite this, shipments were up by 2% for the week ending 19 September. However, the overall trend suggested the wet blue segment remained under pressure, with buyers showing caution in making large purchases.

As the market moved into the final quarter, stakeholders remained cautiously optimistic about the prospects for recovery. Sellers continued to resist lower bids, particularly in more resilient categories like Heavy Steers, while buyers remained cautious in the face of uncertain economic conditions. High slaughter rates and fluctuating demand left the market in a state of cautious stability, with little expectation of significant price movements in the short term.