Branded Heifers stayed steady at around $18.00 for 52/54lbs, while Native Heifers saw a slight firming towards the end of June, averaging $21.50 to $23.00 for 50/52lbs, suggesting a potential upward trend in this segment. However, Plump Cows continued to struggle, reaching an all-time low of $7.00 for 50/52lbs, signalling significant market pressure and weak demand. Dairy Cows and Bulls remained steady, with minimal trading activity reported, highlighting a cautious market environment. Many stakeholders state that the persistently low bidding prices are making it increasingly difficult to justify the costs, pushing them close to considering drastic measures.

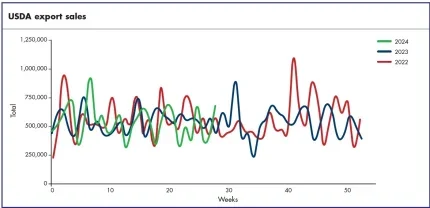

Exports

Raw hide sales showed significant variation throughout the month. Net sales of raw hides for 20 June were up by 38% from the previous week, reaching 395,800 pieces. This increase is encouraging, suggesting a temporary boost in market activity. However, when examining the broader trend, the June average of 322,400 pieces was down 30.62% from May and 22.49% from June 2023. These numbers highlight the ongoing challenges in the market despite the weekly uptick. Major destinations for these raw hides included China, which purchased 300,600 pieces, revealing its significant role in the global hide market. Korea followed with 48,600 pieces, and Mexico with 29,200 pieces, both contributing to the overall sales volume.

Shipments for the week ending 20 June were up 14% from the previous week, totalling 412,600 pieces. This increase in shipments aligns with the rise in sales, indicating a steady movement of goods through the supply chain. However, monthly averages paint a different picture. The overall market health cannot be assessed solely on weekly improvements. June’s average sales were 30.62% lower than May and 22.49% lower than June 2023, showing a decline compared to previous periods.

Wet blue sales also experienced a notable increase. Net sales for 20 June rose by 207% from the previous week, totalling 278,500 pieces. The June average for wet blue sales was 141,600, marking a 13.52% increase from May and a 21.05% increase from June 2023. The primary destinations for these wet blue hides were Vietnam, which purchased 88,200 pieces, Thailand with 79,100 pieces, and China with 44,700 pieces. These countries have robust leather industries, driving demand for high-quality wet blue hides.

Shipments for the week ending 20 June saw a 3% increase, totalling 140,900 pieces. This is a modest rise in shipments supporting the sales data. For the period ending 20 June, the combined total of raw and wet blue hides sold but not yet shipped was 4,144,300, a 3.02% increase from the previous week. This backlog of unshipped hides suggests that while sales are occurring, logistical or production bottlenecks might be delaying the movement of goods. Combined shipments for the same period were 553,500, up 10.77% from the previous week. This increase in combined shipments is a positive development. Could this indicate the industry is managing to move more product, potentially alleviating some of the pressure from unshipped inventory?

The variation in sales and shipments data underscores the complexity of the current market dynamics. While weekly improvements are promising, the overall decline in monthly averages compared to previous periods indicates that the market is still facing significant challenges. Factors such as global economic conditions, shifts in consumer behaviour, and competition from alternative materials continue to influence demand and pricing.

WASDE: Beef production 2024 remains steady, increases expected in 2025

The newest WASDE report reveals that the 2024 forecast for US beef production remains almost unchanged, as a reduction in expected slaughter is balanced by an increase in dressed weights. Looking forward to 2025, beef production is projected to increase due to higher placements in late 2024 and a quicker pace of marketings in early 2025. Additionally, dressed weights are expected to stay elevated into 2025.

US cattle on feed down slightly

Cattle and calves on feed for the slaughter market in the US for feedlots with a capacity of 1,000 or more head totalled 11.6 million head on 1 June 2024, slightly below the previous year. Placements in feedlots during May totalled 2.05 million head, 4% above 2023, with net placements at 1.98 million head. Marketings of fed cattle during May totalled 1.96 million head, slightly above 2023. Other disappearance totalled 62,000 head, 16% below 2023.

Hide market

Federally inspected slaughter for the week ending 22 June reached 620,000, showing a slight increase from the previous week. Year-to-date slaughter totalled 14,969,793, down 4.39% from last year. This increase in slaughter numbers, coupled with the steady prices for various hide selections, suggests that the market is finding a cautious equilibrium.

Many stakeholders in the hide industry have raised concerns over the persistent lowering of demand. Some have expressed the rising popularity of plastics and “sustainable” products is creating a significant shift in the market. High inflation makes it difficult for people to spend discretionary money, especially when living expenses have doubled in some cases. Additionally, some believe the increase in remote work has impacted the demand for highquality shoes and accessories, which would typically see greater interest.

With the back-to-school season approaching, there is hope for increased market activity. The busy season brings the potential for improved demand and better market conditions. Many sellers anticipate an uptick in orders as students and professionals prepare for the new academic year, traditionally boosting the demand for leather goods.

Overall, the market showed signs of stability with a few positive developments, offering a more hopeful outlook compared to earlier in the year. Efforts to maintain price stability continued, and some sellers managed to exceed their weekly production, suggesting potential groundwork for future improvements. Sources remain optimistic that market conditions will improve in the coming months as the busy season begins.

Despite the challenges, the market’s resilience and strategic efforts by stakeholders to adapt to changing demands provide a glimmer of hope for the future. However, it will be essential to monitor these trends closely and adjust strategies as needed to navigate the ongoing uncertainties in the global hide market.