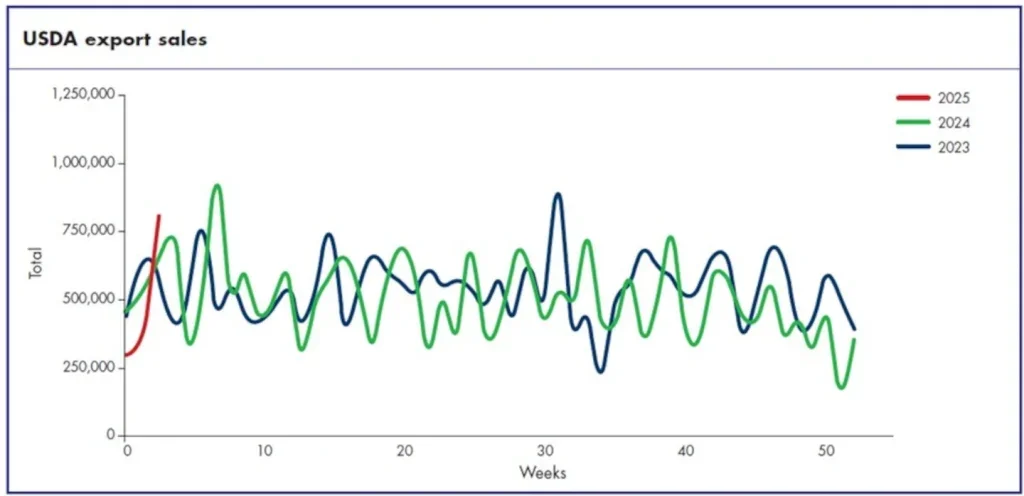

Shipments for the same period totalled 527,300, a 4.89% decrease from the prior period’s 554,400. Despite steady interest in specific steer selections, such as Butt Branded Steers and Heavy Native Steers, market activity remained subdued, with most contracts secured through January limiting major price shifts. Sales fell short of slaughter levels by 170,000 pieces, while shipments lagged behind by 91,700 pieces. Wet blue splits saw mixed results, with 203,800 net sales reported, with major exports going to China and Vietnam.

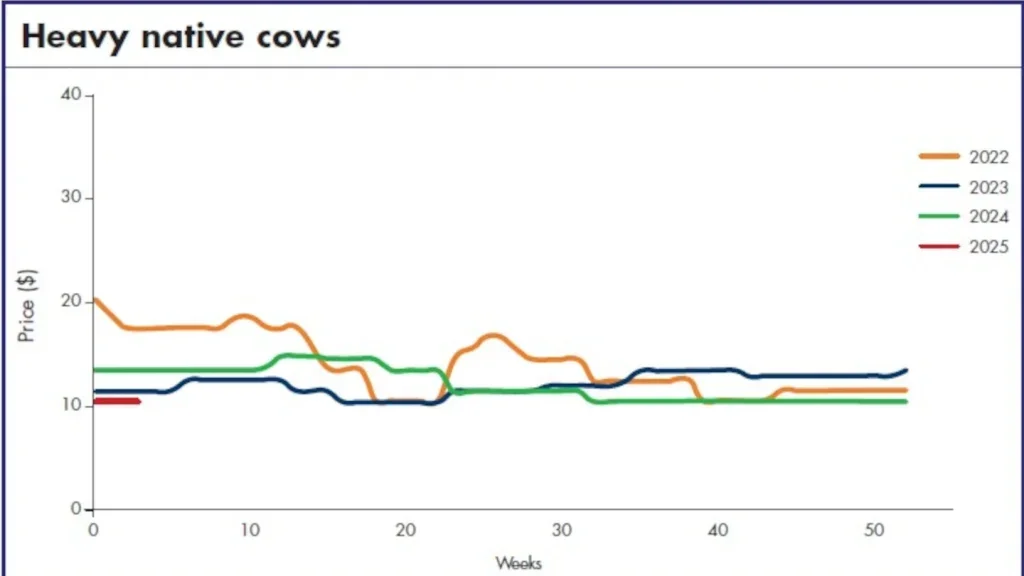

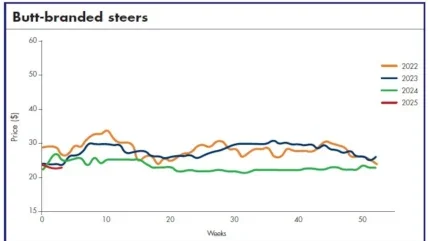

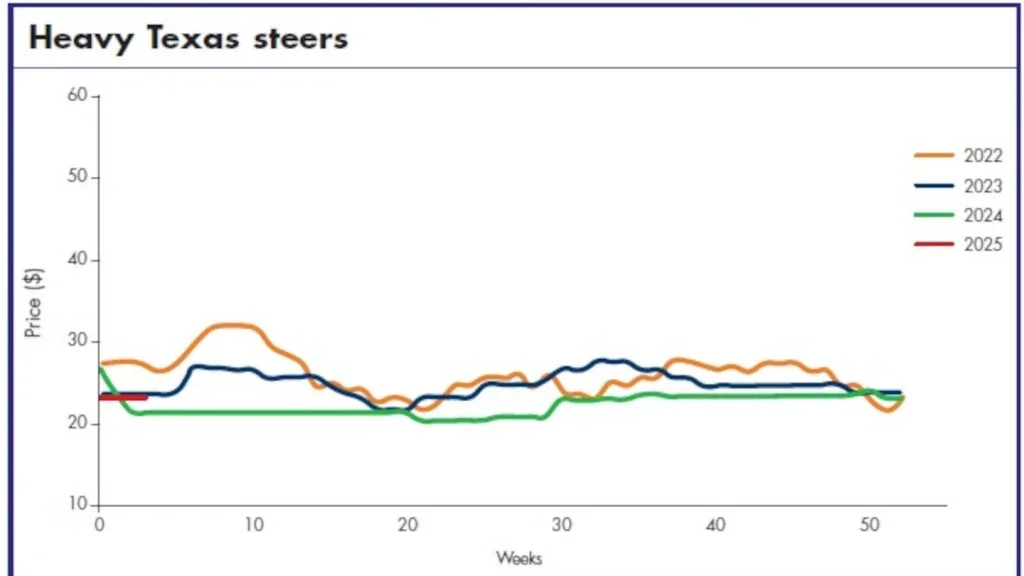

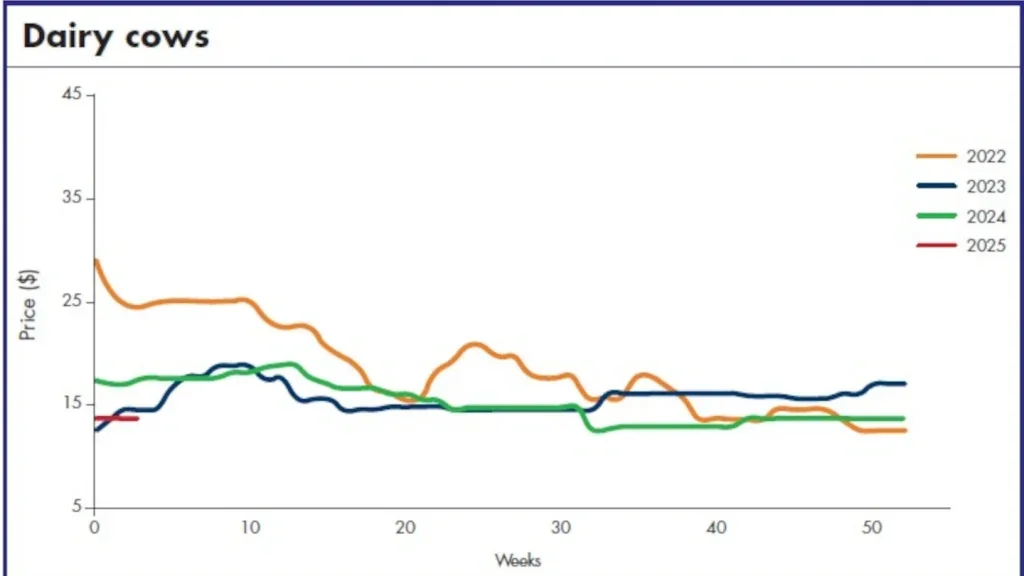

The following period, during mid-November, raw and wet blue hides sold but not yet shipped increased by 1.95%, totalling 3,818,600. However, combined shipments of wet salted and wet blue hides fell to 477,900, a 9.37% drop from the previous period. Federally inspected slaughter for mid-November totalled 606,000, down 2.10% from the previous period’s 619,000. Export sales reached 550,900, but combined shipments were short by 128,100 pieces. Meanwhile, pricing for Butt Branded Steers held steady at $26.00 for 64/66lbs, and Heavy Native Steers maintained stability at $28.00 for 62/66lbs. Despite these stable prices, the market showed signs of pressure, with buyers pushing for lower prices due to a stronger dollar and reduced split credits. Wet blue sales experienced a sharp 50% drop, indicating uneven demand across sectors. In late November, the market remained quiet due to the Thanksgiving holiday, with a shorter trading week. The focus was primarily on cow hides, which traded at steady levels. Sales and shipments continued to fall short of slaughter, with a 16.32% drop in federally inspected slaughter, which totalled 528,000 for the week ending 30 November. This was a significant decline from the previous period’s 631,000. Despite the quiet market, industry news highlighted concerns over a potential halt in US cattle imports from Mexico due to the detection of the New World screwworm, which could impact beef production and prices. Global trade developments and extreme weather conditions added further uncertainty, as the industry faces a complex and volatile market environment.

Exports

In early November, raw hide sales showed a slight decline of 6%, with net sales totalling 335,500 pieces. This was down from 356,300 pieces the previous week and 393,900 two weeks before that. Despite the drop in sales, the overall demand for hides and skins remained stable compared to the prior month.

In contrast, wet blue sales experienced a notable rise of 10% during the same period, with 88,500 units sold. This was up from 80,800 in the previous week and significantly lower than the 177,900 units sold two weeks prior. However, shipments of wet blues saw a 6% decrease, falling to 140,900 pieces from 150,100 the prior week. Despite the drop in shipments, figures remained steady when compared to two weeks earlier. Mid to late November saw a dramatic 51% rise in raw hide sales, with net sales reaching 506,600 pieces, a significant improvement from the previous weeks’ 335,500. The increase in sales suggested stronger demand or improved market conditions for hides and skins. On the other hand, wet blue sales took a sharp decline, dropping 50% to 44,300 units. This marked a significant contrast to the previous week’s 88,500 sales and was also lower than two weeks prior, which saw 80,800 units sold. While the sharp drop could indicate fluctuating market trends or reduced production capacity, it signals a potential challenge for the wet blue sector in the short term.

Despite the fall in wet blue sales, shipments for mid to late November experienced a modest 5% rise, reaching 147,200 pieces. This marked a slight recovery from the prior period’s 140,900 shipments, though it remained below the 150,100 units shipped two weeks before that. Meanwhile, overall hide and skin shipments saw a fall, with a 14% decline, totalling 330,700 pieces, and a corresponding 11% drop from the prior four-week average. These fluctuating trends in raw hide and wet blue sales highlight the ongoing volatility in the market, with varying demand for different product types from week to week. Although raw hides saw substantial growth, wet blues faced significant challenges, underscoring the complexity of global demand and the influence of market factors on the leather industry.

US cattle and calf inventory for feedlots increases slightly over previous year

As of 1 November 2024, the number of cattle and calves on feed in US feedlots with a capacity of 1,000 or more head totalled 12.0 million, slightly higher than the previous year. In October 2024, placements in feedlots reached 2.29 million head, a 5% increase from October 2023. Net placements for the month were 2.23 million head. Cattle placements by weight included: 585,000 head weighing less than 600lbs, 480,000 head between 600-699lbs, 490,000 head between 700-799lbs, 436,000 head between 800-899lbs, 215,000 head between 900- 999lbs, and 80,000 head weighing 1,000lbs or more. Marketings of fed cattle in October totalled 1.85 million head, also 5% higher than the previous year. Other disappearance for October was 55,000 head, unchanged from the same month in 2023. These figures reflect continued growth in the cattle and beef industry.

Hide market

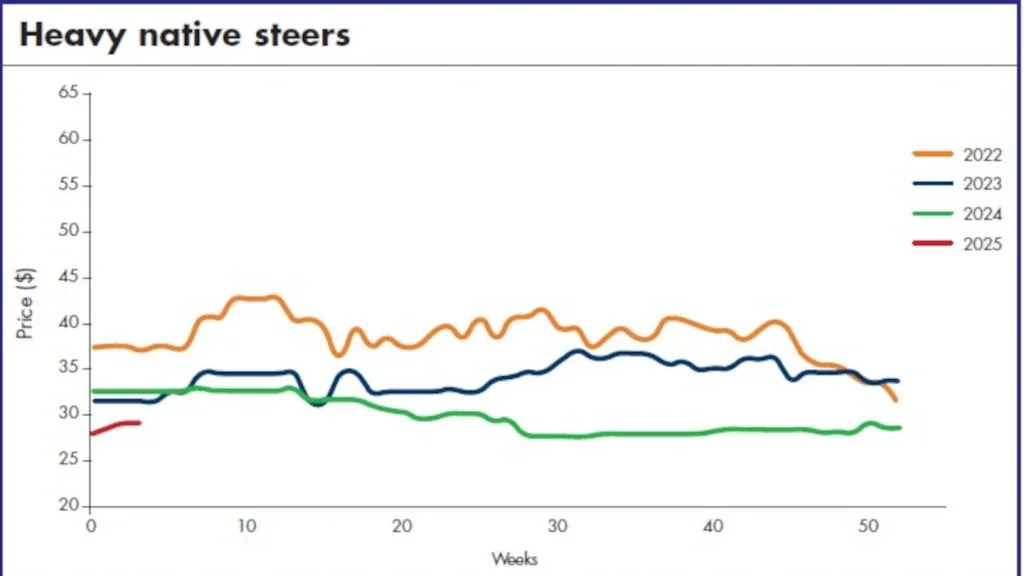

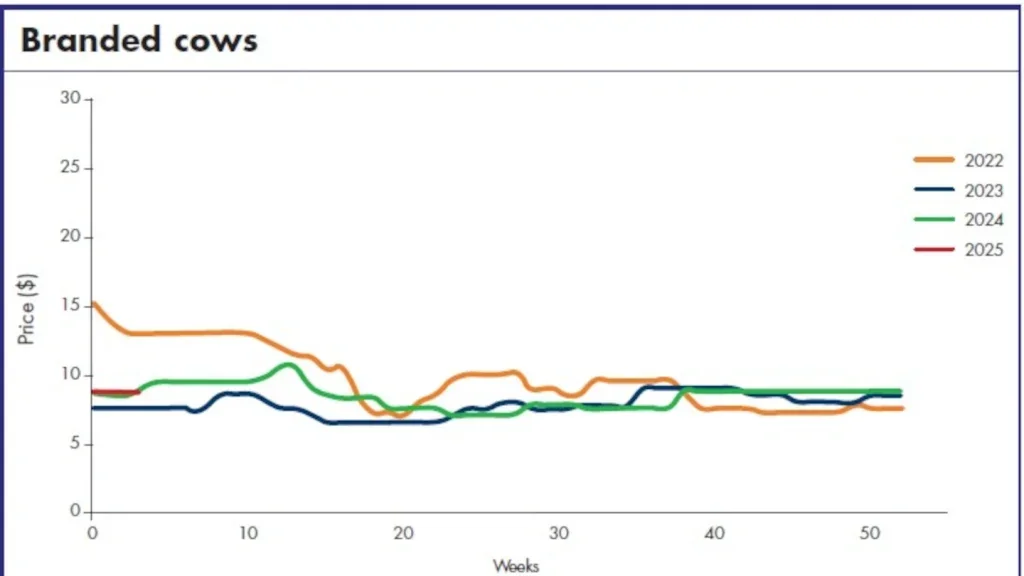

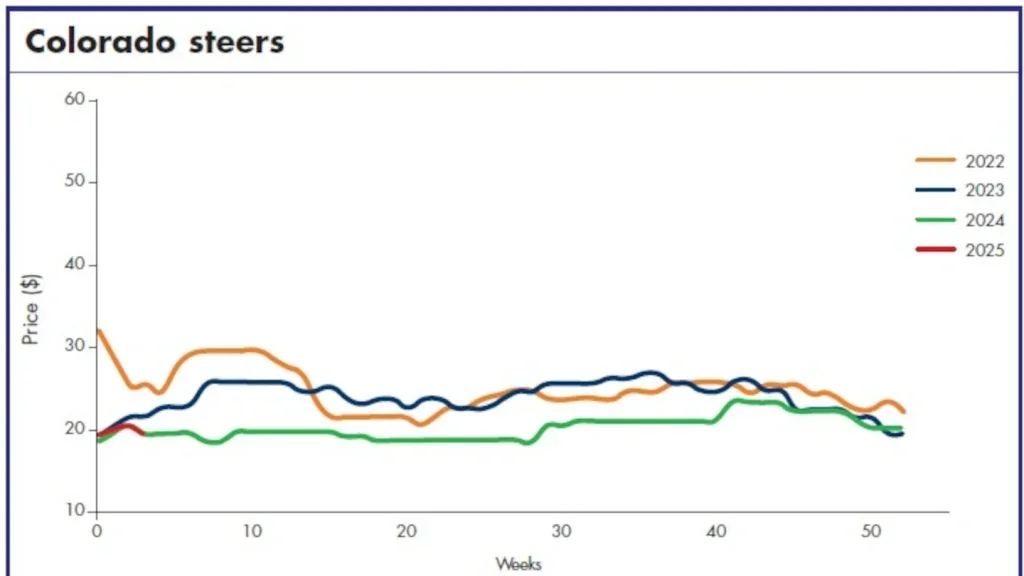

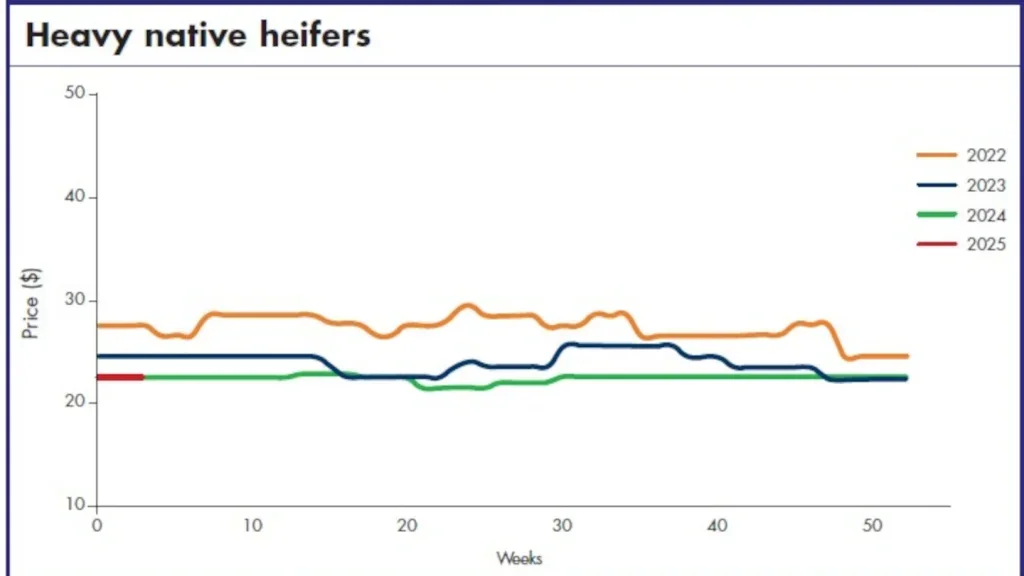

The hide market remained relatively steady over the period, with some firmness observed in specific steer selections, such as Native and Butt Branded hides. However, overall activity was quiet, with most contracts secured through January limiting significant price shifts. Sellers have been facing ongoing challenges, particularly with low bids and price pressures, driven by a stronger US dollar. Additionally, concerns about China’s declining drop split market have added further uncertainty. Despite these pressures, many sellers have remained firm on their prices, unwilling to accept lower bids. As anticipated, the market has continued to show stability, particularly for specific steer types like Butt Branded Steers and Heavy Native Steers. However, demand has been inconsistent across different sectors. While raw hide sales gained some momentum, wet blue sales faced significant declines, signalling uneven demand. Buyer resistance remained high, especially as the strength of the US dollar and reduced split credits continued to put pressure on prices. There was some hope for preholiday purchasing, particularly from Chinese tanners preparing for the Chinese New Year, but this impact remains uncertain. Recent market conditions have reflected many of the challenges forecasted, including steady prices and buyer resistance. Sales volumes for both hides and wet blue remain constrained, with few major price shifts observed. Reports indicate that slaughter levels have not kept pace with sales, making it difficult to match supply with demand. Even with this tight balance, trading volumes were slow, and prices were steady within a narrow range. The upcoming period will likely reveal whether Chinese New Year purchasing activity provided a boost or whether further price adjustments will be necessary.

In addition to these market pressures, global events have contributed to the cautious outlook. Issues such as a strike by Indian port workers, concerns over drought conditions in the US, and disruptions in shipping logistics due to extreme weather events like Typhoon Kong-rey all influenced supply chains. On the trade front, the US halting cattle imports from Mexico due to the discovery of New World screwworm raised concerns over potential impacts on beef production and prices. These events underscore the complex and interconnected nature of the hide market, requiring ongoing adaptability from industry participants.