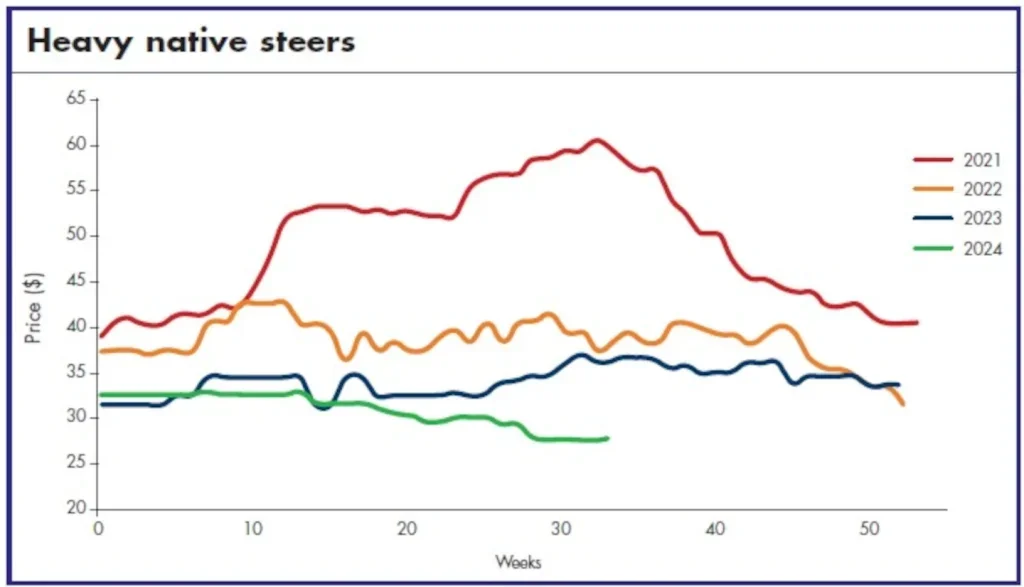

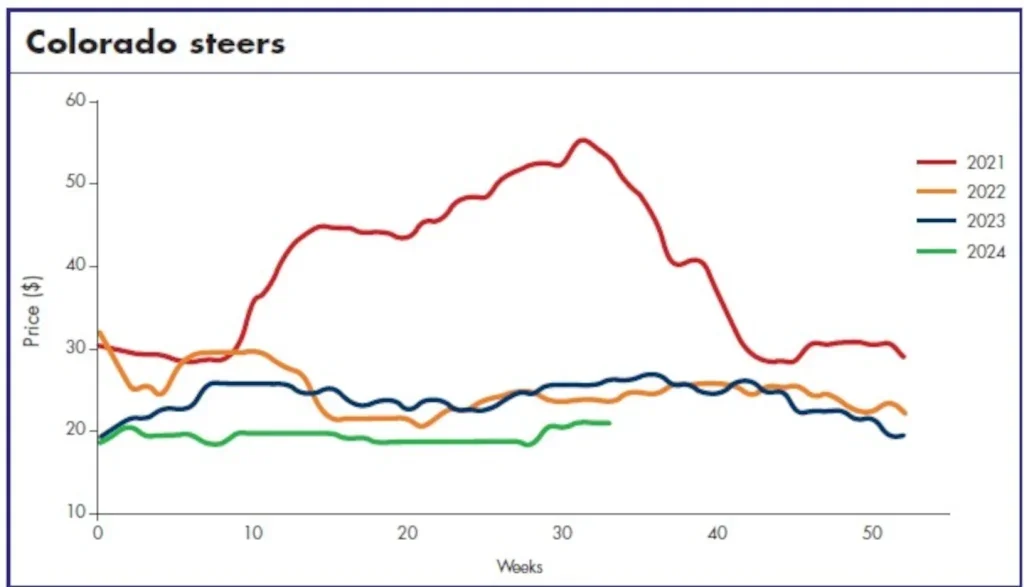

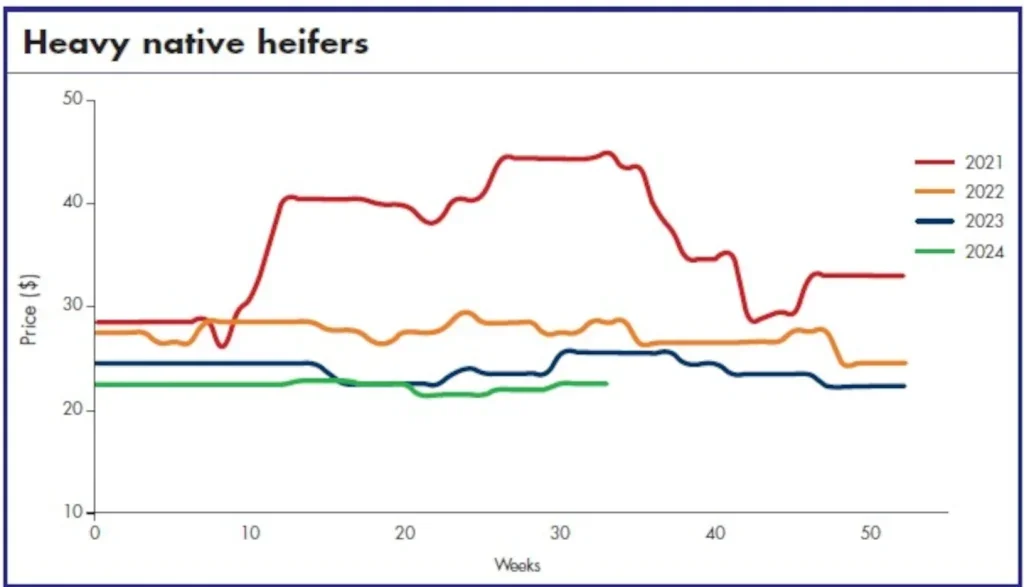

Heavy Native Steers maintained stability, continuing to sell within the range of $27.00 to $28.00 for 62/64lbs. This consistent pricing underscores the segment’s resilience, as it has managed to hold steady despite broader market fluctuations. The stability in this category has shown a steady demand for higher-quality hides, which are often used in premium products that tend to be less sensitive to price changes.

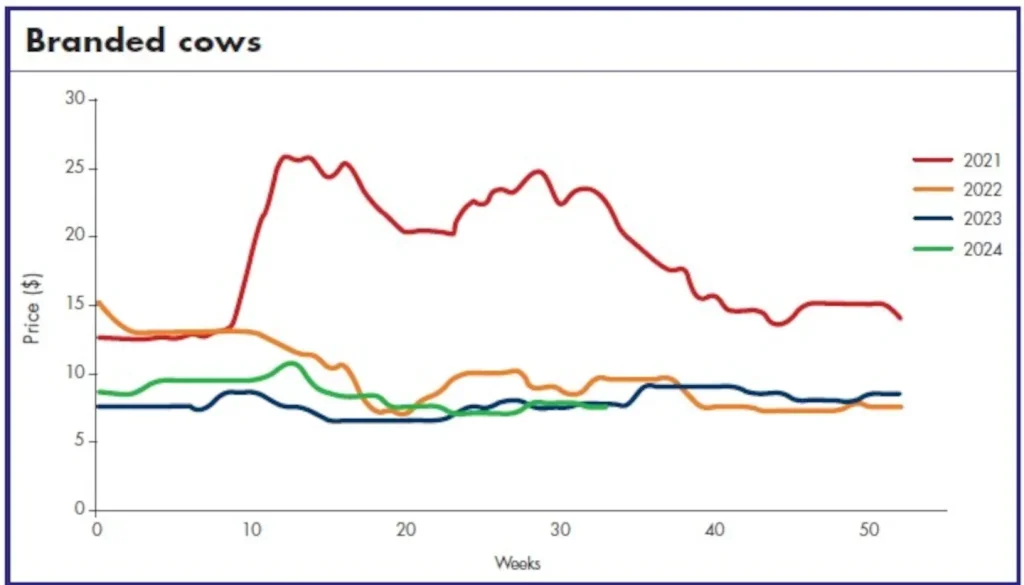

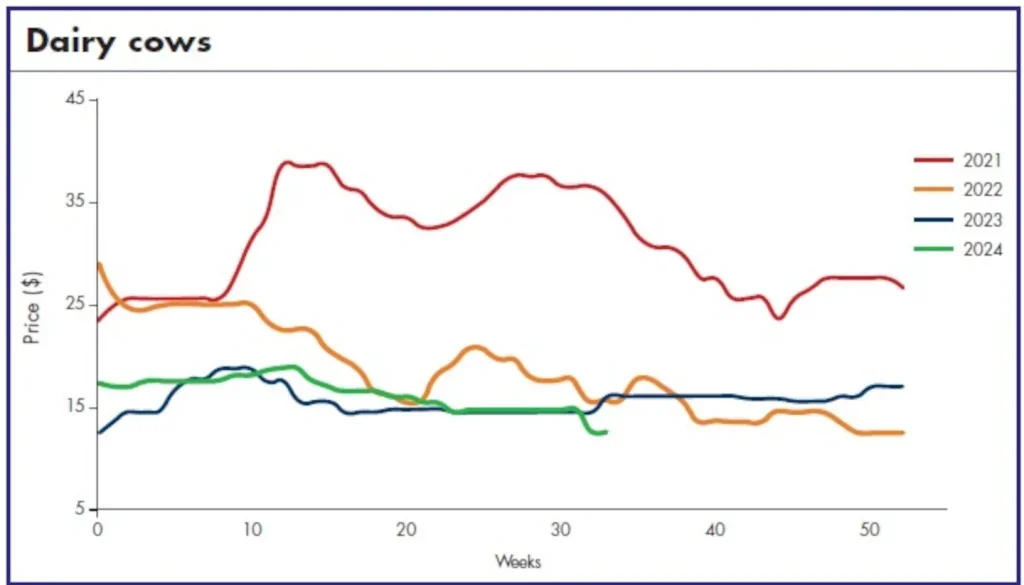

Branded Heifers remained steady at $17.50 for 48/50lbs, while Heavy Native Heifers sold for $22.00. However, the market for Plump Cows showed no significant movement, continuing to struggle with weak demand. The market overall remains sensitive to fluctuations in buyer behaviour, with some segments showing resilience while others face ongoing challenges. As the market continues to navigate these mixed signals, industry stakeholders are likely to remain cautious, closely monitoring trends and adjusting their strategies to align with the evolving landscape. The gradual improvements seen in some areas offer a glimmer of hope, but the overall market environment remains complex and uncertain, requiring careful management and strategic planning to ensure continued progress.

Exports

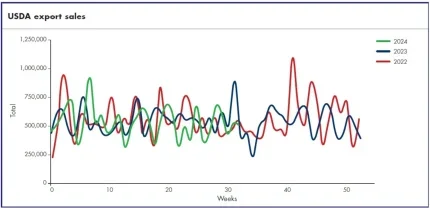

Raw hide sales in July presented mixed results. Net sales for 18 July totalled 443,800 pieces, a 7% decline from the previous week’s 476,000. Despite this dip, the July average of 399,125 pieces was up by 23.80% from June, indicating a gradual recovery. However, this figure was only slightly up by 0.75% compared to July 2023. China remained the leading destination, purchasing 368,300 pieces, followed by Brazil with 20,100 pieces and Mexico with 16,200 pieces.

Shipments of raw hides for the week ending 18 July increased by 7%, totalling 384,800 pieces, up from the previous week’s 359,500. Despite the weekly improvement, July’s average shipments were down by 3.44% from June and 8.16% from July 2023. Wet blue sales faced a more significant decline, with net sales for 18 July dropping by 22% to 156,300 pieces, down from the previous week’s 199,200. The July average for wet blue sales was 115,500 pieces, marking an 18.43% decrease from June and a 13.09% decrease from July 2023. Italy and Vietnam were the top buyers, purchasing 85,900 and 48,500 pieces, respectively.

Shipments of wet blues for the week ending 18 July saw a notable increase of 26%, reaching 150,700 pieces, up from 119,300 the previous week. This rise in shipments provided some relief, but overall, July’s average shipments were still 3.72% lower than in June, underscoring the market’s volatility.

For the period ending 18 July, the combined total of raw and wet blue hides sold but not yet shipped was 2,979,300 pieces, a significant 27.7% decrease from the previous week. This drop reflects the ongoing challenges in matching sales with shipments, despite occasional improvements in weekly data.

WASDE: Beef production forecast increased for 2024 and 2025

‘The World Agricultural Supply and Demand Estimates Report’ for 12 July 2024 presents an updated forecast for US livestock, poultry and dairy production, with notable changes in the cattle sector. For 2024, beef production is projected to increase due to higher expected steer and heifer slaughter, which more than compensates for reduced cow slaughter. This trend continues into 2025 where beef production is again raised on similar grounds. However, beef imports for 2024 are reduced due to expected global competition, while exports are boosted by stronger than anticipated demand in key markets. There are no changes to beef trade forecasts for 2025.

In terms of pricing, cattle prices for 2024 are increased based on recent data and firm demand for fed cattle, a trend expected to persist into 2025 with further raised price forecasts. This reflects a positive outlook for the beef market, driven by robust domestic and international demand, despite some competitive pressures in imports. Overall, the report indicates a solid performance for the US beef industry, underpinned by strong market fundamentals and strategic adjustments in production and trade.

US cattle on feed up 1%

As of 1 July 2024, the total number of cattle and calves on feed for the US slaughter market in feedlots with a capacity of 1,000 or more head reached 11.3 million, marking a 1% increase from the same date in 2023. This inventory includes 6.82 million steers and steer calves, also up 1% from the previous year, making up 60% of the total. Heifers and heifer calves accounted for 4.48 million head, showing a slight increase from 2023. June placements in feedlots totalled 1.56 million head, 7% below 2023, with marketings of fed cattle at 1.79 million head, down 9% and the second lowest June total since 1996. Other disappearance for June was 57,000 head, a 17% decrease from the previous year.

Hide market

Federally inspected slaughter for the week ending 27 July reached 600,000, up by 2.74% from the previous week. Year-to-date slaughter totalled 17,885,917, which is 4.45% lower than the previous year. Despite these difficulties, stakeholders in the hide industry are hopeful that the approaching fall season will bring renewed activity. With schools and workplaces gearing up for a new year, there is potential for increased demand for leather goods, which could bolster market conditions. Many sellers are optimistic that this seasonal boost will help stabilise prices and improve overall market sentiment.

Moreover, the industry is closely monitoring global economic trends, particularly in key export markets, where consumer behaviour could play a significant role in shaping demand. As the back-to-school and holiday shopping seasons approach, there is anticipation that a revival in consumer spending could drive orders for leather products, from footwear to accessories. Additionally, industry players are exploring innovative ways to appeal to a more sustainability-conscious market, which could open new opportunities for growth.

While the hide market continues to face significant challenges, the resilience and adaptability of industry stakeholders offer hope for the future. Efforts to stabilise prices and manage production are crucial as the market navigates ongoing uncertainties. As the busy season approaches, there is cautious optimism that the market will see an uptick in demand, helping to offset some of the difficulties experienced earlier in the year.