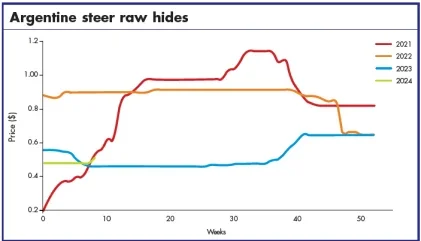

Argentina

Steers were selling at $0.52/kg, cows at $0.33 and heifers at $0.55. Per capita beef consumption fell 18.5% in March to 42.6kg compared to the same month. It was the worst record in 30 years. During the first quarter, beef consumption was 17.6% lower than in the same period last year.

Australia

After slipping in January, wet blue ox prices stabilised through the beginning of the second quarter of 2024. Grade A selections at 23–27kg were steady at $45.00 per piece, and selections at 18–23kg were unchanged at $38.00.

Australia exported 106,574t of beef in March, 8% more than last year. The standout increase was exports to the US, which rose by 58% year-on-year to 29,346t. Domestic US beef production continues to decline, pushing the amount of beef in cold stores down and pulling imports up.

Bangladesh

Bangladesh’s leather exports rose by 9.8% over last year. Sales of semifinished raw materials in July to March of 2023–24 totalled $100.40m, according to the Export Promotion Bureau (EPB).

A spike in exports to China is helping local suppliers increase volumes and China has begun importing a significant quantity of semi-finished leather from Bangladesh to remain competitive by keeping production costs low. At the same time, the Bangladesh government issued eight directives to develop the leather industry up to international standards and achieve the export target of $12.5bn by 2030.

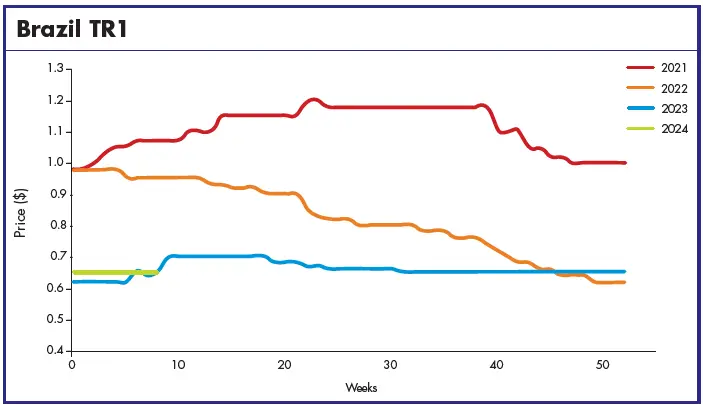

Brazil

Brazilian raw material prices finally broke their months-long flat levels in April. The average price of fresh hides rose by 17 cents to sell at R$1.02/kg. This pushed the reference price of TR1 higher, to $0.70 per sq ft.

Brazil’s March exports of hides and skins were up by 5.5% over the same month last year. The data was presented by SECEX (Foreign Trade Secretariat) of the Ministry of Development, Industry, Commerce and Services and analszed by CICB. As for volume, 16.0 million sq m and 48,600 tons were exported, 13.9% and 31.5% over the same month in 2023, respectively. Compared to February, the increases were 8.4% in area and 3.8% in weight. The first quarter of the year totalled $312.3m in exports, 12.3% above the same period in 2023, with increases of 17.6% in area and 28.5% in weight.

Chile

Chilean wet blue prices remained under pressure through the spring. TR1, full substance 16mm+ was selling 5 cents lower at $0.70 per sq ft.

China

China’s February imports of raw hides >16 kg totalled 72,389,909kg overall, 32% less than in January. In terms of pieces, as well as value, the decline was 33%.

For raw hide purchases from the US, China bought 27% less in kg than in January. In pieces and value, the February totals were 29% less. US raw hides accounted for 41% of China’s total purchasing in kg and pieces and 45% in value.

In February, China imported 17% less wet blue than in January in terms of kg. In value, the total was 22% less. February wet blue purchases from the US were down by 6% in kg and 10% in value compared to January. US wet blue accounted for 21% of China’s total purchasing in kg, and 29% in value.

Colombia

Colombia’s raw material market continued its long-term price stability. Salted hides weighing 26–28kg were steady at for $0.40/kg, while those at 30–32kg were selling unchanged at $0.50/kg. Wet blue TR1/TR2 20/22mm+ was also stable at $0.42 per sq ft.

Colombian trade officials restricted the import of US beef and beef products from US states testing positive for highly pathogenic avian influenza as of 15 April, according to the US Department of Agriculture’s Food Safety and Inspection Service (FSIS). US trade officials said the ban is unfounded. The US is Colombia’s biggest supplier of imported beef.

Finland

Finnish cow hide prices were stable through to May. Trading was reported at a steady €1.10kg for hides delivered to Northern Italian tanneries. Bulls, which dopped in early 2024, weakened further in April. Average green weights of 34kg and up sold at €1.30kg.

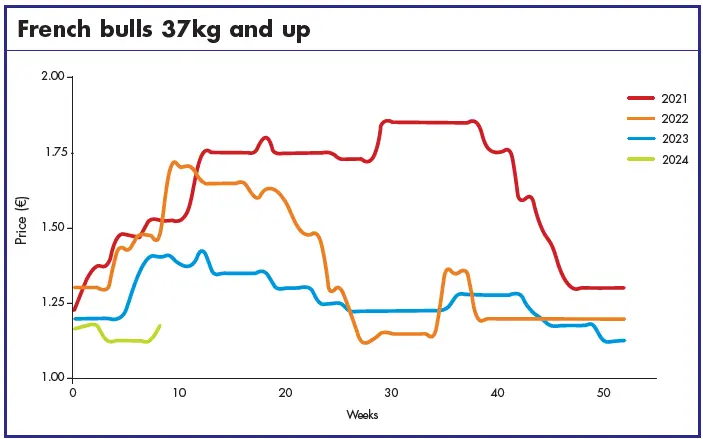

France

French veal skins declined in the spring and then remained stable to early May. French black/white selections weighing 8–12kg, were down at €4.00–4.30 and those over 13kg were at €5.50–6.00. The price for 13+ kg luxury selections was at €6.-0–6.50. The 8–12kg luxury selections were at €4.50–4.80.

After declining early in the year, French cow prices were higher. Central French 32kg+ were 10 to 15 cents higher at €0.90–1.00. Lighter selections under 32kg were up by 10 cents at €0.80–0.85. The 32+ selection was steady, selling at €0.95–1.05.

Furniture and automotive business was still weighing on the French bull market, with prices a bit lower. French Bretagne selections 37kg+ were softer at €1.25–1.35. The under 37kg selection was 5 cents lower at €1.15–1.25. Among Central French hides, the 37kg+ was firmer at €1.15–1.25 as was the 37kg and under category at €0.95–1.05. Overall, demand was sporadic and supply was tepid, with European slaughterhouse production confirming early April figures, which were strong.

The French leather industry ended 2023 with a trade surplus of just over €5bn, with stable imports of around €14bn, and exports up 6% to €19bn. This is even though France ended the year with a trade deficit close to -€100bn.

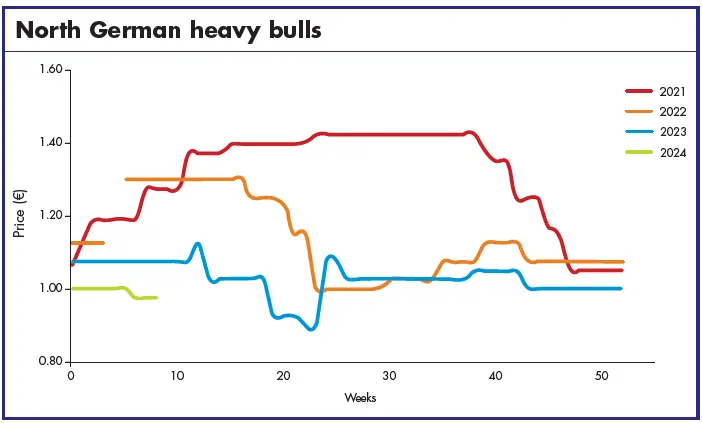

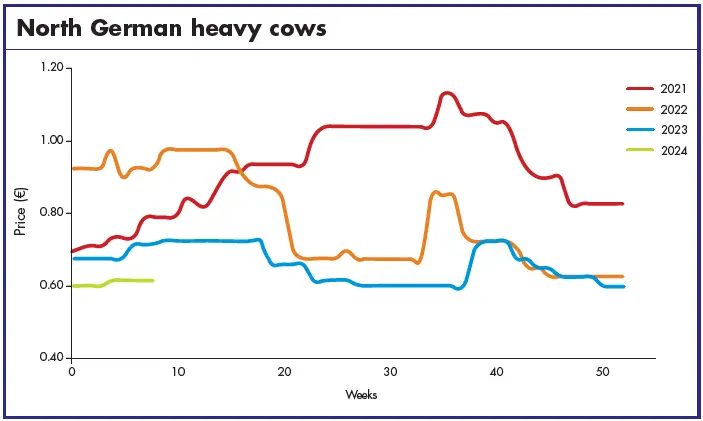

Germany

Some German cow hide prices firmed up by the time May arrived. The 25 kg+ north German cows were selling at €0.65/kg. Lighter weights of 15–24kg were also 3 to 5 cents higher at €0.70–0.75. Conversely, cow hide prices in southern Germany were weaker: 40 kg+ selections sold for €0.90–0.95/kg. The 30–39kg selections were stable, selling at €0.75–0.80.

German heifer prices were mixed in the late spring. North German 25kg+ were weaker at €0.80–0.85/kg but the price was still €0.95 for the 15–24kg from the same region. South German heifers again saw declines. The 40kg+ were 5 to 10 cents lower at €1.00–1.05, but the 30–39kg selection was higher at €1.10–1.15.

German bull prices remained relatively stable through the spring. South German bulls were at €1.25–1.30 for the 40–49kg selections.

Greece

The price of lamb and sheepskins from Greece slipped during the spring months. Sales of lambskins (70/20/10) were $10.00–15.00 lower at $110.00–125.00 per dozen, pickled. Lambskins (C2) were also lower, selling for $35.00–$45.00 per dozen, pickled.

India

After dropping lower in January, India’s buffalo market prices remained stable through to May. Crust 1.4– 1.6mm was trading at $0.50–0.55 per sq ft. Crust 0.9– 1.1 mm was also unchanged at $0.40–0.45.

West Bengal’s leather goods industry is on track to grow by 10% in the fiscal year ending March 2024. The Indian Leather Products Association attributes this to a shift in sourcing strategies, which increased demand for Indian leather products. Major leather clusters in India, including West Bengal, are seeing a surge in demand, cutting China’s share of the global leather supply chain from 34–35% to around 20%.

Iran

Having dropped in the spring months, prices stabilised. Mutton skins (AB) were selling at $95.00 per dozen, pickled. Super mutton skins were selling for $35.00. Prices on medium goatskins were $1.00–3.00 lower at $11.00–12.00.

Italy

Italian cow prices firmed in the spring. Prices were at €0.55–0.60/kg. Italian bulls were also firmer at the top end, adding 5 cents to the range. They were selling at €0.95–1.05 for 40kg and up average green weight.

Italian veal prices slid lower. The 18+ kg skins were down by another 20–30 cents, selling at €3.80–4.00/kg.

Netherlands

Dutch veal skin prices, which had fallen lower, were stable through to May. The 12.5kg selections sold at €4.00–4.50. Skins at 16.5kg traded at €5.00–5.50. Dutch cow hides were still relatively steady, selling at €0.60–0.65kg. All prices quoted are on material delivered to Northern Italian tanneries on a 30-day payment schedule.

New Zealand

New Zealand market prices had mixed changes. Wet blue ox, selection 70–30%, 20–24kg, was higher at $47.00 per piece. Heavier 27+ kg added $1.00, selling for $61.00. Wet blue heifers were higher at $47.00 for the 18–23kg selection. Wet blue cows, selection 70–30%, added $2.00 at $25.00 for 14–18kg.

Nigeria

Nigerian raw material maintained its long-unchanged price levels. Cross lamb A was still stable at €2.70 per sq ft crust. ABC goat skins were likewise unchanged at €1.50 per sq ft.

Norway

Norwegian cow prices remained unchanged through early May. Seasonal weight selections were selling for €1.60. Norwegian bulls were also stable, with the 34kg and up average green weight selections trading at €1.80kg.

Pakistan

Pakistan’s buffalo prices remained stable. Sales were at $0.55 for crust, 1.3–1.5mm.

Poland

Polish cow prices firmed in the spring months. Selections weighing 26–27kg sold at €0.60–0.65. Conversely, bull prices were 10 cents lower, with 40kg selections selling for €1.00.

Spain

Despite market tranquility, sourcing raw materials in Europe is difficult because the most requested skins are rare and prices remain high. Nonetheless, prices at the start of May were lower than in our last report. Spanish entrefino for nappa was at €14.00–15.00. Entrefino doubleface was $1.00–1.50 lower at €11.00–12.00. Double-face merino prices were steady at €12.00–14.00. The lachaune selection was $1.00 lower at €4.00–4.50. Prices are ranged to reflect the different regions in Spain, from lower end to top end quality. They are quoted on an FOB origin basis, per piece (5.5–7ft range, 6.5ft avg.).

Spanish cow prices were unchanged at €0.65– 0.70kg. Prices for bulls 40kg and up average green weight were firmer, at €0.90–1.00.

Sweden

Swedish cow prices remained stable through the spring at €1.15–1.20kg. Bull prices softened in late April with 34kg and up average green weight selections at €1.40kg.

Turkey

Turkish raw materials were unchanged through the spring. Bulls were selling at $0.95-1.00/kg while cows were at $0.65–0.70/kg.

Demand for bulls rose in the spring, with wet blue exporters being the main buyers. Demand for cow hides, however, was low. Meat consumption was higher than usual during Ramadan, but slaughter was only a little higher because meat prices are high considering the minimum wage. Demand was quite minimal for low-quality lamb and sheep. The price is around $2.00–2.50 for lambs but sheep had no price because demand was too low. Leather and leather products exports in January–February 2024 totalled $263.5m, down by 24.5% compared with the same period last year. Exports of leather and fur apparel totalled $17.3m, down by 28%.

UK

English prices remained stable through until the start of May when they declined. The UK 36+ ox was at £80.0/kg. In Ireland, the 36+ ox dropped to €0.87kg.

US

Weak demand continued to weigh on the US steer market. Heavy Texas steers held a steady streak for a few months, with prices at $22.00 for seasonal weights. The US cow market saw demand drop in late April, but prices were weakly steady at the start of May.

In April, the USDA raised its forecast for beef production due to heavier weights and higher slaughter.

Vietnam

Vietnam’s leather and footwear industry exported over $24bn in 2023, a 14% decrease from 2022. Total industry exports for 2024 are expected to range from $26bn to $27bn for an increase of 10% over the same period of 2023. Estimates of footwear exports are expected to reach $22.3bn. Footwear exports increased by 15.6% for the first two months of 2024 for a total of $3.73bn compared with the same period last year.