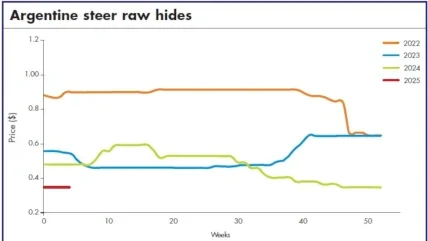

Argentina

Heifer prices remained steady at $0.52 per kg, bolstered by local tanneries producing shoe leather. The wet salted market saw limited inactivity.

Australia

The Australian wet blue ox market remained stable, with no notable price fluctuations across all grades. Grade A prices held steady, ranging from $33 for 14-18kg pieces to $63 for those over 31kg. Similarly, Grade B prices remained unchanged, with 14-18kg pieces priced at $21 and those exceeding 31kg at $56. Grade C also saw no movement, with 18-23kg pieces at $25 and larger pieces over 31kg holding steady at $43.

Bangladesh

The Bangladesh leather industry is facing challenges in expanding exports due to the need for better effluent treatment and LWG certification. The government is allowing tanneries like Apex and Bay Leather to set up private effluent plants to ease pressure on the central facility, with upgrades expected to help more tanneries obtain LWG certification and boost exports, potentially reaching $5bn annually. Meanwhile, the FAO is distributing silos and cattle feed to flood-affected farmers in northern Bangladesh to protect livestock. Tannery workers are also calling for the government to set a minimum wage of Tk18,001, while Apex Tannery is signing new contracts to increase sales of finished leather.

Benelux

The Benelux market remained stable, with no notable price changes. Green hides weighing 30.0-39.0kg stayed at $1.00 per kg, while heavier hides, ranging from 40.0-49.0kg, remained priced between $0.90-$0.95 per kg.

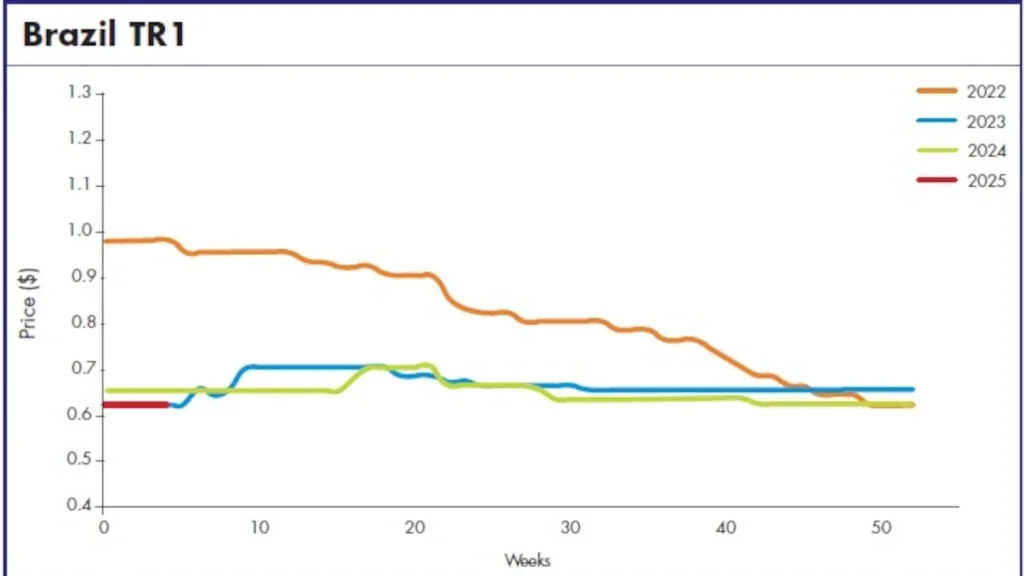

Brazil

Brazilian fresh hide prices edged down to R$0.91 per kg, with Zebu hides ranging from R$0.65-R$0.90 per kg and Gaucho hides priced between R$1.10-R$1.20 per kg. While hide prices remained stable, the cattle market experienced significant price increases, with beef cattle reaching over R$355.40 per arroba by late November, driven by limited supply and strong export demand. However, leather sales in Brazil’s domestic market were slow, weighed down by weak demand and global instabilities. International markets, particularly in Asia and Europe, saw minimal activity, as high inventories and low bids pressured prices. While there are expectations for potential improvements in the new year, the overall market outlook remains cautious.

Chile

The Chilean wet blue leather market remained unchanged, with TR1 hides priced at $0.80 per square foot, TR2 at $0.70, and TR3 at $0.60. Hides 16mm+ also showed stability, with TR1 at $0.70, TR2 at $0.60, and TR3 at $0.50 per square foot.

China

China’s raw hide imports remained relatively stable, with slight increases in total weight but a small decrease in total pieces and value compared to the previous period. Specifically, imports from the US grew marginally in weight and pieces, though the value declined. Conversely, China’s imports of wet blue cowhide, both overall and from the US, saw significant declines, with a 26% drop in volume and value. Meanwhile, in the business realm, Chinese and Pakistani leather and footwear companies signed MoUs worth $156m at a B2B investment conference in Guangzhou, aiming to strengthen trade and investment ties. Additionally, Hong Kong will host APLF Leather, Materials+, and Fashion Access in March 2025, with over 900 exhibitors from more than 40 countries, including a new sustainability zone focused on eco-friendly practices.

Colombia

The Colombian leather market remained stable, with no price changes across any categories. Salted hides weighing 26/28kg were priced at $0.40 per kg, while 30/32kg hides held steady at $0.50 per kg. Wet blue hides followed a similar pattern, with TR1/TR2 20/22mm+ priced at $0.42 per square foot and TR3 at $0.34 per square foot.

Finland

The Finnish hide market experienced pressure and price fluctuations. Cow hide prices fell to €0.80 per kg, a notable decrease from the steady €1.10 per kg earlier this year. Similarly, bull hides, averaging 34kg and above, dropped to €1.00 per kg during this period.

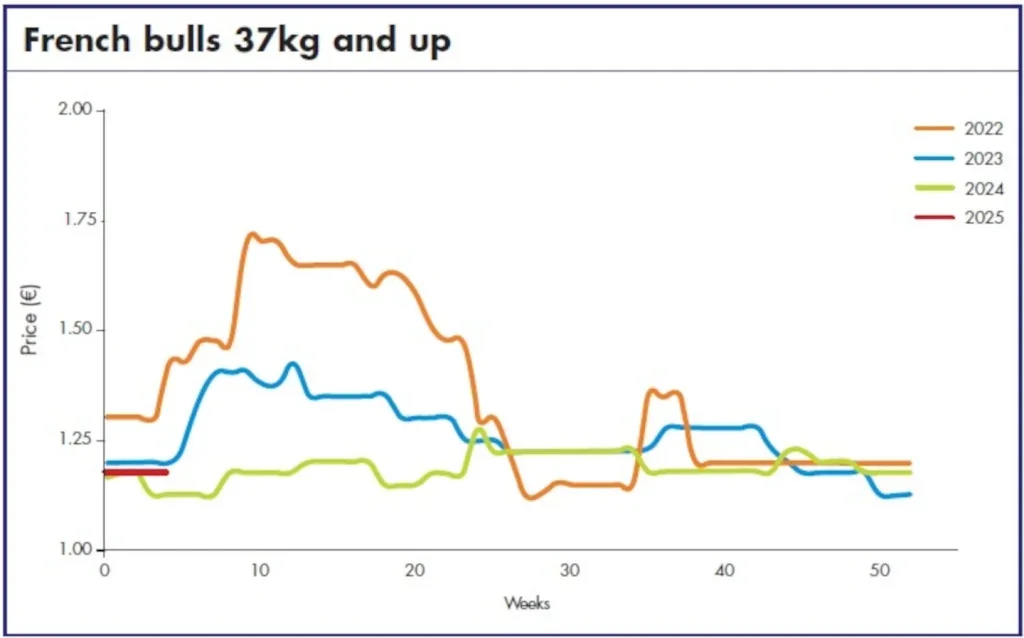

France

Veal skins, especially those used for luxury leather goods, saw a decline, with prices ranging from €5.80-€6.30 per kg for 13+ kg luxury skins and €4.50-€5.00 per kg for smaller 8-12kg skins. French cow prices were slightly weaker, with larger cow hides from Bretagne trading between €0.95-€0.98 per kg, while hides from central France dropped to €0.85- €0.88 per kg. Bull prices also decreased, with Central French bulls weighing 37kg and up falling to €1.00-€1.10 per kg. However, despite reduced slaughter rates and price pressures on certain grades, demand for high-quality leather helped keep the French market relatively stable.

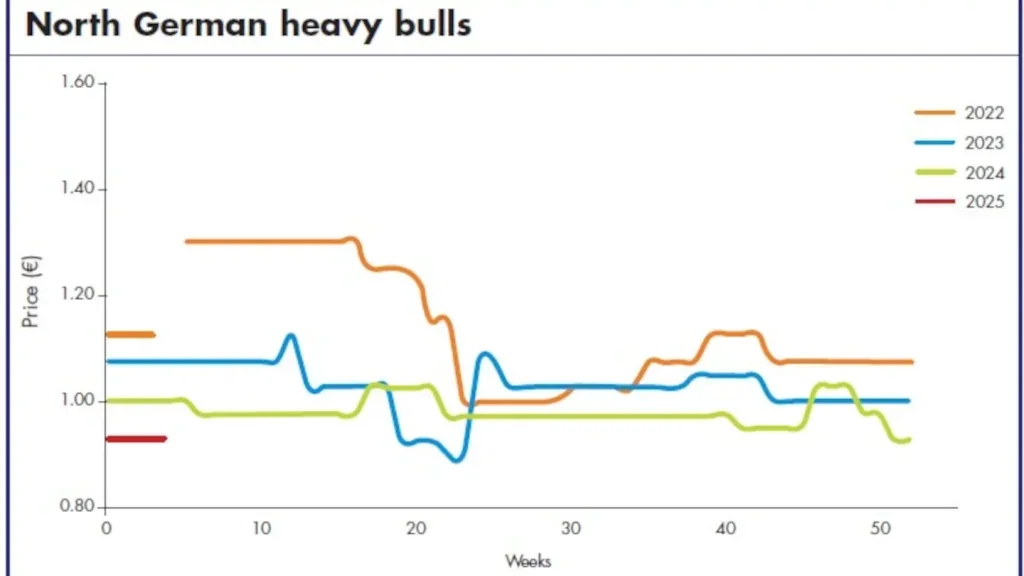

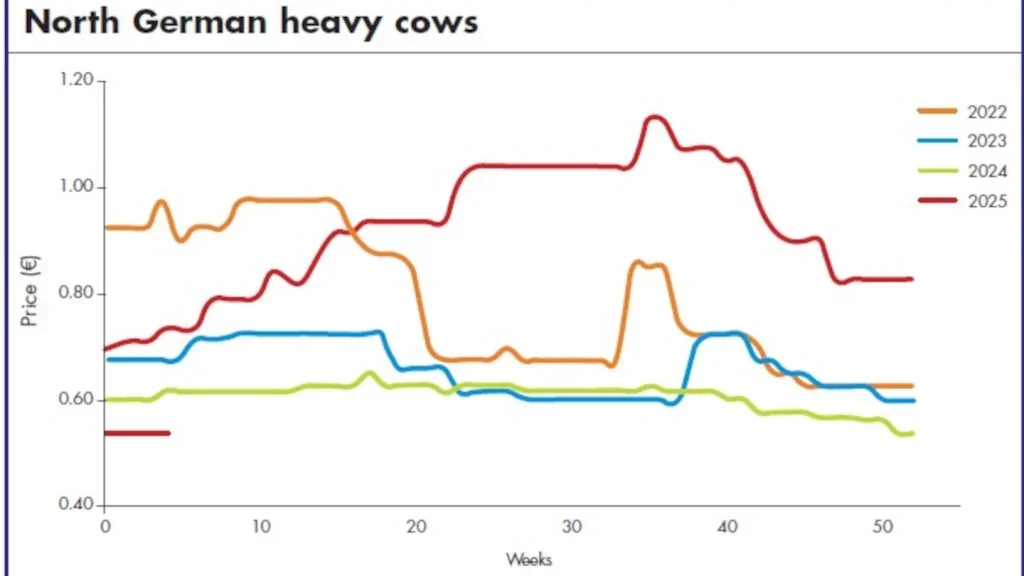

Germany

In northern Germany, cow prices for 25+ kg hides ranged from €0.55- €0.58 per kg, while larger cows from southern Germany (40+ kg) were priced at €0.88- €0.91 per kg. Bull prices in southern Germany held steady, with 40-49kg hides selling for €1.18-€1.22 per kg and larger 50+ kg hides reaching €1.28- €1.30 per kg. Heifer prices remained stable, with northern German heifers over 25kg trading at €0.80 per kg, while southern German heifers weighing 40+ kg dropped to €1.00 per kg. Despite limited new orders and ongoing market tensions, prices were largely maintained, with minor fluctuations depending on size and region.

Greece

The Greek lamb and sheep skin market remained stable in October and November, with no price changes across any categories. Pickled lamb skins in the 70/20/10 grade stayed at $110-$125 per dozen, while C2 lamb skins continued to trade between $35-$45 per dozen.

India

Crust buffalo hides, especially the 1.4-1.6mm grade, remained stable at $0.60 per square foot. Likewise, the 0.9-1.1mm hides held steady at $0.50 per square foot during the same period.

Iran

The Iranian muttonskins (AB) remained stable at $95 per dozen, while the 2B category held steady at $65 per dozen, and super-quality muttonskins were priced at $35 per dozen. Medium goatskins also maintained their price range of $11-$12 per dozen during this period.

Italy

Italian veal skins maintained consistent pricing, with larger skins (18kg and up) priced between $3.50- $3.80 and smaller skins (18kg and under) holding more or less steady at $3.00-$3.30. Italian cow prices saw a slight decline, dropping to $0.48-$0.52 per kg. Meanwhile, the Italian bull market softened, with prices for bulls weighing 40kg and up falling to $0.80-$0.85 per kg.

Netherlands

Dutch large veal skins (16+ kg) remained consistently priced between €5.00-€5.40 per kg, while smaller skins (8-12kg) stayed at €4.00-€4.60 per kg. Despite an oversupply of smaller sizes, demand for larger skins met expectations, keeping premium veal skin prices firm. Cow prices in the Netherlands fell to €0.55 per kg during this period. Overall, the market showed stability, driven by strong demand for high-quality veal skins, especially in the larger sizes.

New Zealand

New Zealand wet blue ox hides remained stable, with 20-24kg hides priced at $49 per piece, and larger sizes also holding steady. Wet blue heifer prices were consistent, with 14-18kg pieces at $36 and 18-23kg pieces at $48. Wet blue cow prices remained unchanged across both weight categories. No data was available for lamb and sheep skins during this period.

Nigeria

The Nigerian market for Grade A lambs remained stable, with prices holding at €2.70 per kg, while Grade L goats stayed steady at €0.60 per kg during this period.

Norway

Norway’s leather market weakened, with cow prices for hides weighing 17+ kg falling from $1.60 to $1.30 by late November. Hides weighing 34kg also saw a decline, dropping to $1.40 during the same period.

Pakistan

Pakistani crust buffalo hides in the 1.3- 1.5mm range stayed steady at $0.60 per square foot, while those in the 0.9- 1.1mm range remained stable at $0.50 per square foot. The market maintained stability, with prices remaining strong through the end of November.

Poland

The Polish cowhide market experienced pressure, with prices trending lower. Cowhides weighing 26/27kg dropped to €0.60-€0.65 per kg, while larger hides weighing 40kg and above dropped a similar amount in price.

Spain

The Spanish lamb and sheep market remained stable, although demand softened, particularly in footwear. Premium selections such as Entre Fino and Merino doubleface maintained prices of €10.00-€11.00 and €12.00-€14.00 per skin, respectively. Tanneries operated carefully, with fewer orders leading to weaker production. Cowhide prices stayed firm at €0.60 per kg.

Sweden

Swedish cow prices softened to €0.90 per kg, and green-weight hides of 34kg and above also decreased to €1.10 per kg. Despite these declines, the market largely maintained stable pricing across key categories, with the price drops attributed to weak demand.

Turkey

Turkey’s tanning industry is grappling with significant economic difficulties. Although demand for cow and bull hides remains low, reduced slaughter rates have kept prices steady, with bulls priced at $1.00-$1.10 and cows at $0.70-$0.80. High interest rates have stabilised the Turkish lira but increased labour and borrowing costs, which are impacting exporters. Both the tanning and textile sectors are under pressure, potentially causing further disruptions. Lamb prices remain unchanged, ranging from $3.50 to $4.50 per piece.

UK

The UK and Irish ox and heifer markets remained stable in November, with minor price fluctuations across different weight categories. English 36+ hides were consistently priced at £0.68-£0.70 per kg, while smaller hides (31- 35.5kg) maintained the same pricing. Irish prices increased slightly, with 36+ hides ranging from €0.86- €0.88 per kg. Contrary to earlier expectations of a price drop, prices held steady, though continuing negotiations exerted some pressure. In the lamb and sheep market, prices remained unchanged, with sheep skins priced at £1.00-£1.50 each and hoggets at £1.75-£2.30 each. No data was available for new season lambs.

US

The US hide market remained stable overall. Prices for heavy Texas Steers and Butt Branded Steers held firm at $24.00 and $26.00, while Branded Steers remained at $21.00. Raw hide exports stayed at 39%, and wet blue sales saw an uptick. However, shipments were delayed, indicating logistical challenges. While sellers largely maintained pricing, economic concerns and cautious buyer sentiment left the market outlook uncertain.

Vietnam

Vietnam’s footwear industry has grown significantly, with a 25% increase in exports to the UK in 2023, fuelled by the UK-Vietnam Free Trade Agreement (UKVFTA). This has helped the country become the world’s secondlargest footwear exporter, with over 100 South Korean companies investing in the sector. Meanwhile, Vietnam’s furniture exports to the US surged by 40% in 2023, though concerns about potential new tariffs pose a risk. On the agricultural front, Japan is expanding its Wagyu beef sales in Vietnam, with a notable rise in demand for premium beef in high-end restaurants and hotels.