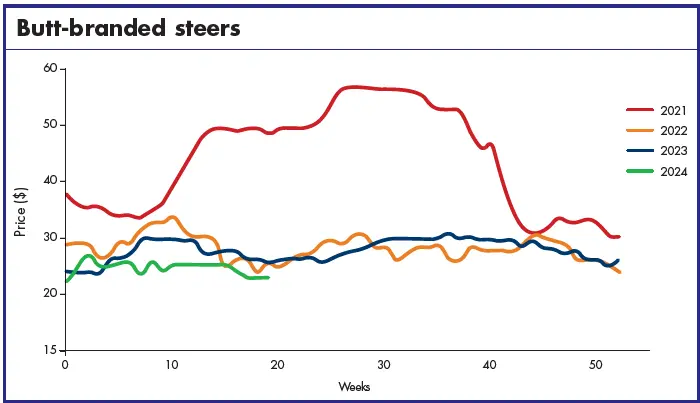

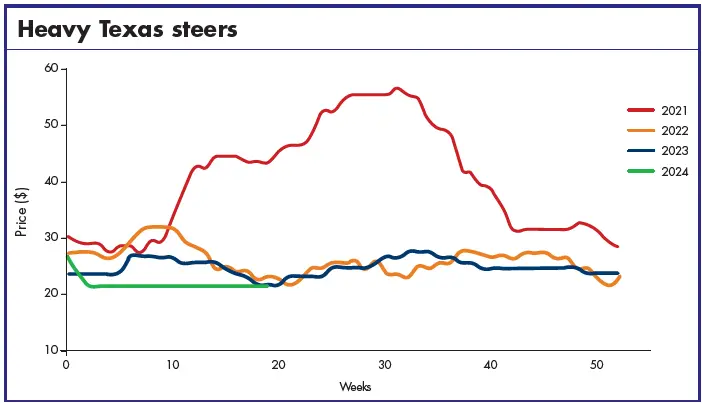

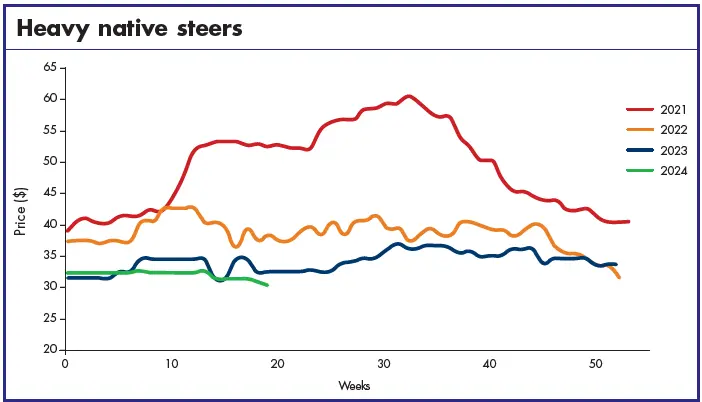

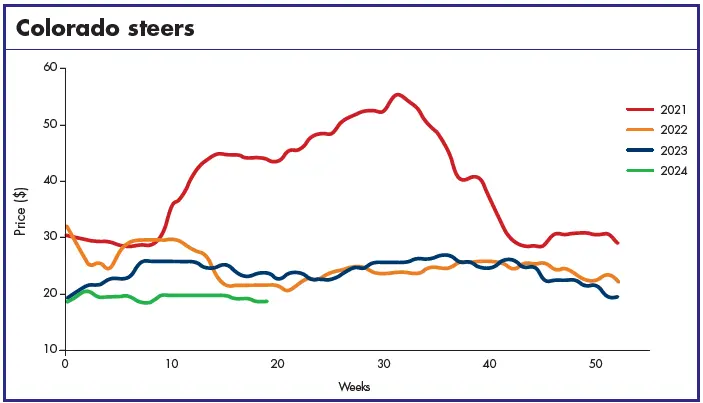

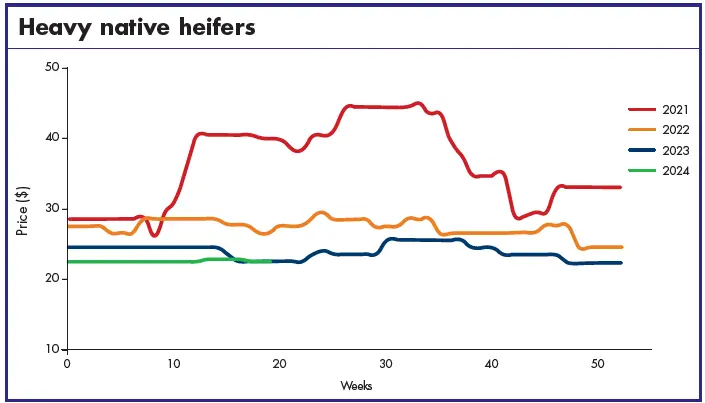

Heavy Texas steers have had uncharacteristically flat prices so far in 2024. Seasonal weights were selling at $22.00, which they had been since January. Colorados, on the other hand, had dropped early in the year but stayed weakly steady at $19.00 for 64/66lb selections. The automotive sector, which was expected to reactivate in the second quarter, was not living up to predictions. Purchasing was scant and deliveries delayed. Consequently, heavy native steers and butt-branded steers were under pressure and prices slipped a little lower.

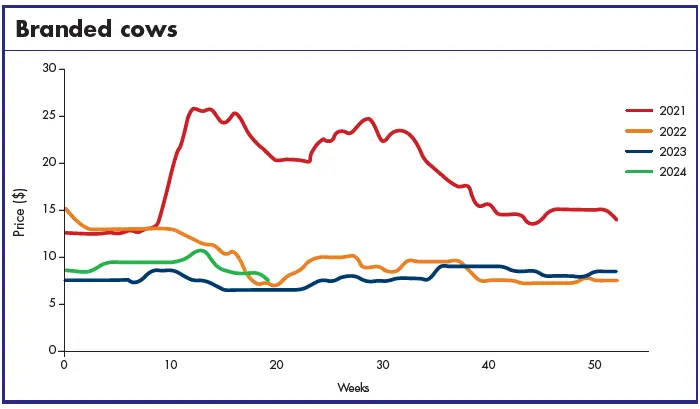

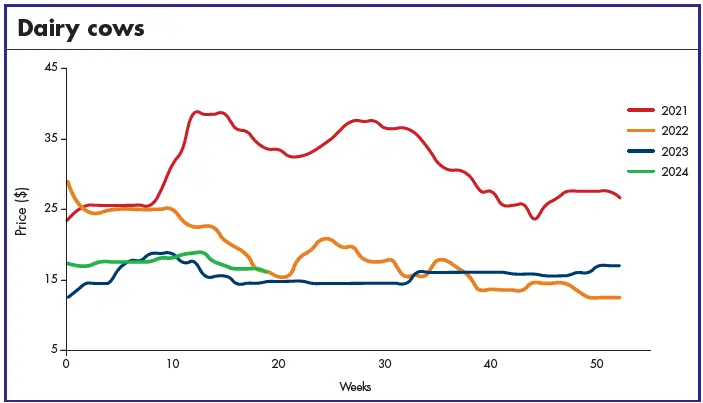

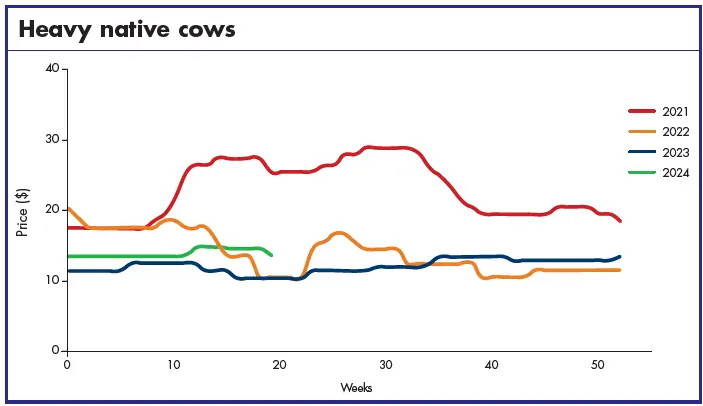

Cow sellers, who had enjoyed good interest for upholstery and handbags, saw that come to an end in April. When interest fell off, customers started trying to push prices lower, although at the start of May, levels were still stable.

Exports

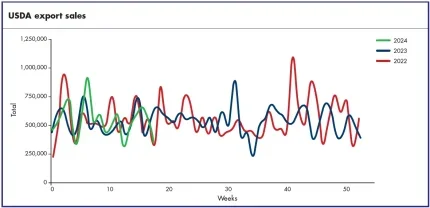

Weekly raw hide sales averaged 313,375 in March. This is down by 20% from February and 9% from March 2023. Average Q1 sales were 379,108, which is 3% lower than Q4 and 4% lower than Q1 of 2023.

Average raw hide shipments in March were 379,708. This is 19% lower than in February and 17% lower than in March last year. Q1 shipments averaged 379,708, which is 11% lower than both Q4 and Q1 of 2023.

For wet blue, March sales averaged 142,250. This is 44% lower than in February but 22% higher than in March 2023. Average Q1 wet blue sales were 166,185. This is 25% higher than Q4 in 2023 and 46% higher than Q1 last year.

Weekly wet blue shipments in March averaged 131,000, down by 16% from February but up by 3% from the March 2023 average. Quarterly wet blue shipments averaged 135,262. This is 6% lower than Q4 of 2023 but 9% higher than the same quarter last year.

WASDE again ups 2024 red meat production forecast

In April, the USDA again raised the forecast for 2024 red meat and poultry production. Beef production was raised due to heavier weights and higher slaughter. Beef exports were raised for 2024 based on recent trade data and cattle prices were also raised for the year based on recent data and expected strength in demand.

US cattle on feed up 1%

Cattle and calves on feed for the slaughter market in the US for feedlots with capacity of 1,000 or more head totalled 11.8 million head on 1 April, 2024. The inventory was 1% above 1 April 2023. The inventory included 7.27 million steers and steer calves, up 2% from the previous year. This group accounted for 61% of the total inventory. Heifers and heifer calves accounted for 4.56 million head, up 1% from 2023.

Placements in feedlots during March totalled 1.75 million head, 12% below 2023. Net placements were 1.69 million head. During March, placements of cattle and calves weighing less than 600lb were 330,000 head, 600–699lb were 260,000 head, 700– 799lb were 460,000 head, 800–899lb were 466,000 head, 900–999lb were 170,000 head, and 1,000lb and greater were 60,000 head. Marketings of fed cattle during March totalled 1.71 million head, 14% below 2023. Other disappearance totalled 57,000 head during March, 8% above 2023.

Hide market

The first half of 2024 was not panning out as expected for the US hide market. Business was forecasted to be slow for some destinations, but others were supposed to fire up from their low levels of activity, which did not happen.

After the Lunar New Year, larger customers were slow to return to the market. Even when they did, bids remained very low and sales prices no better than steady. This was not surprising given the weak state of the global leather market, confirmed by February’s Lineapelle, which yielded no real positives. No big surprises and no real changes was the market mantra for many weeks.

Concerning the US hide supply, slaughter started the year aligned with predictions, being more than 5% lower than in 2023. That changed in April, when totals started ticking upward each week, even though packer margins were deeply in the red. As the traditional US barbeque season approached, totals were expected to rise even further. And, while supply does not drive the market without adequate demand, it can help support price levels.

On the demand side, the automotive sector was not living up to expectations. An increase in activity was forecasted for the second quarter, but by early May automotive customers had yet to start serious buying. This left heavy native steers and buttbranded steers under pressure.

For footwear, a few larger tanners expressed that their finished leather orders were a little better than expected. The challenge for them was getting higher prices for the finished material. Moreover, the slightly improved scenario was not the case across the board for the footwear sector, as some brands and groups were doing better than others. Customers in Mexico continued to complain about a lack of leather orders and slow business, while automotive tanning there was also sluggish.

Cow sellers had a positive start in early spring, bolstered a bit during the Hong Kong Fair. Upholstery business sagged in April, however, and prices were under pressure. Good positions allowed sellers to hold levels steady for a number of weeks, but by early May, buyers were adamant they would not pay steady levels, certainly not for large volumes. At the same time, rumours started to circulate about shipments not being picked up and languishing in some Chinese ports.

Sources say business is down by half for some upholstery tanners. There had been an uptick in interest for cows and lower-grade materials. Furniture upholstery tanners were shifting to using more leather because the durability is better, and at these levels the price can be competitive with synthetics.

In the pre-pandemic era, it used to be that prices firmed up before APLF and ACLE and one could expect some changes to emerge from business at the fairs. Travelling sellers were typically able to conclude a good amount of business as they visited customers. Like many other industry maxims, these phenomena have changed or disappeared as the market has evolved.

The leather industry’s recovery will have to wait for the second half of 2024. Customers everywhere have plenty of hides in warehouses, as many confirmed while travelling in Asia.

After the fair, market sentiment turned negative. It wasn’t long before customers started bidding aggressively lower, refusing to pay even steady prices. While a slowdown is typical of the post-fair market, it was also suffering an overall depression in the leather industry.

Throughout the spring, prices were weaker in general. As could be expected, rumours of belowmarket sales again ramped up.

Compared to historical averages, prices remain very low in the US hide market. As cheap as hides are, it is difficult to imagine that they need to go lower, but many sources say they probably will in the next weeks and months.